The Jerusalem real estate market is defined by high demand and limited supply. Driven by population growth and strong international interest—especially from the Jewish Diaspora—property values in the city have shown long-term appreciation and resilience.

Why Jerusalem Real Estate Is Unique

- Limited Land & Zoning Restrictions: Stringent zoning laws and historic preservation severely limit new construction, particularly in central neighborhoods—pushing property prices upward.

- Diverse Neighborhoods: Each area in Jerusalem offers a unique lifestyle, community, and price point—your choice of neighborhood significantly impacts your budget and investment potential.

- Consistent Demand: Whether for permanent residence, vacation homes, or investments, interest in homes for sale in Jerusalem remains high year-round.

Key Jerusalem Neighborhoods & Property Prices

Luxury & High-End Areas

- Talbiye & Rechavia: Central, elegant, and historic. Luxury apartments and villas range from ₪55,000 to ₪85,000+ per sqm.

- German Colony & Baka: Anglo-friendly with charming homes and vibrant communities. Prices typically range ₪35,000–₪55,000 per sqm.

- Mamilla & City Center: High-end apartments steps from the Old City. Expect ₪70,000–₪100,000+ per sqm.

Family-Friendly & Good Value

- Old Katamon & Arnona: Great for families, offering space, schools, and community. ₪28,000–₪40,000 per sqm.

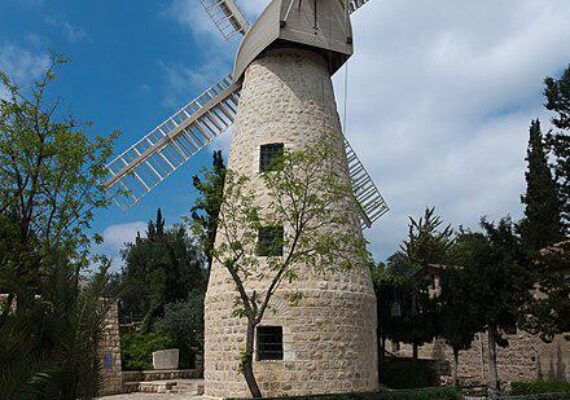

- Nachlaot: Quirky and historic near Mahane Yehuda Market. Smaller properties with lots of character.

Emerging Investment Areas

- Kiryat Yovel & Ramat Sharet: More affordable (₪20,000–₪30,000 per sqm), with infrastructure upgrades like new light rail lines improving appeal.

Buying Property in Jerusalem: A Guide for Foreign Buyers

Legal & Financial Steps

- Hire a Real Estate Attorney: Essential for title checks, contracts, zoning compliance, and confirming land ownership (private vs. ILA leasehold).

- Understand Taxes:

- Purchase Tax: Non-residents pay 8–10% based on property value.

- Arnona (Municipal Tax): Annual, based on size and location.

- Capital Gains Tax: Applies upon resale; consult a tax advisor.

- Financing Options:

- Israeli Mortgages: Available to foreigners with 40–50% down payment.

- Currency Exchange: NIS fluctuations can impact total cost.

- Due Diligence:

- Inspect older properties for structural issues or renovation needs.

- Review “Vaad Bayit” (building committee) finances for apartments.

Investment Potential in Jerusalem Real Estate

- Strong Rental Market: High demand for both long-term and short-term rentals, especially in central areas. Be aware of local Airbnb regulations.

- Urban Renewal Projects: TAMA 38 and Pinui Binui projects offer future upside but require patience and legal insight.

- Long-Term Appreciation: Historically, Jerusalem property values rise steadily due to limited land and consistent demand.

Final Thoughts

Buying property in Jerusalem is more than a financial investment—it’s a meaningful connection to a city with deep cultural, religious, and historical roots. With the right team and clear understanding of the process, you can confidently find your home or investment in one of the world’s most sought-after real estate markets.